M Group Composite Investment Fund

M Group COMPOSITE INVESTMENT FUND

The M Group COMPOSITE INVESTMENT FUND (the “Fund”) is an in-house best practice compliant investment that aims to achieve high-yielding business income and medium to long term capital growth by investing in a diversified portfolio managed by M Group.

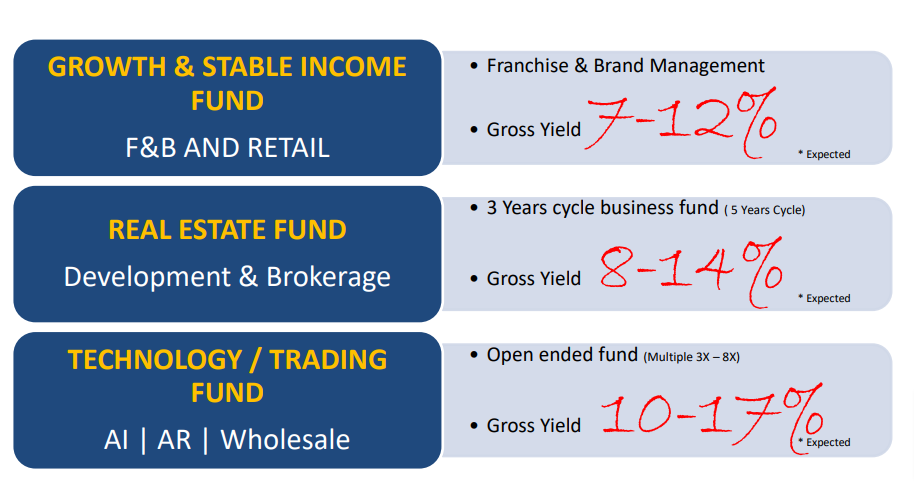

The Fund will focus predominantly on Real Estate , F&B and Hospitality, General Trading and TECH (AI & AR) sectors throughout the UAE, whilst retaining the flexibility to invest in markets outside of the UAE. The Fund aims to retain some liquidity by maintaining an element of the portfolio in cash or cash equivalent investments. The Fund may also consider exposure to Retail Trade in order to manage any excess liquidity whilst aiming to maintain Optimal level returns.

Brief On Private Funds

- Private funds (M-CIF) enable managers to pool capital without having to navigate the cumbersome securities registration process involved in launching like REIT (Real Estate Investment Trust) or other publicly-offered investment fund.

- Most private funds offer their investors a preferred return, together with a split of the fund’s overall net profits. (Hurdle Rate)

- Since investments in running business are liquid, private funds have many unique structural issues that must be addressed. An initial consideration is whether to use an open-end or closed-end fund structure. Many investors favor the open-end structure, which, in the simplest form, allows investors to enter and exit the fund at regular intervals determined by the fund’s sponsor.

- Private funds possess certain unique capital needs based on the nature of the fund’s investment assets. Most funds utilize a “draw down” structure where investors are required to make an initial capital contribution at the time the fund accepts investment subscriptions. The remaining amount of each investor’s capital commitment is periodically “called down” by the fund

M Group COMPOSITE INVESTMENT FUND

Return On Investment

- Most private funds offer their investors a preferred return, together with a split of the fund’s overall net profits. The structure that specifies the order in which a fund’s profits and losses are allocated among investors and the fund’s manager/ sponsor is often referred to as the “waterfall.” Waterfalls vary widely in their structure and operation, depending upon a private fund’s investment assets and overall investor profile.

Generally, profits are allocated in the following order

- investors will receive a return of their capital contributions

- investors will receive a preferred return, calculated on the total amount of their capital contributions while such sums are held by the private fund

- the fund’s manager/ investors will receive an allocation equal to a portion of the total preferred return allocated to the investors (usually in the same percentage as the profit split and referred to as the preferred return “catch-up” or sponsor/ GP “catch-up”)

- finally, the remaining profits are split between the investors and the fund’s sponsor (M-CIF) after achieving Hurdle Rate (7%) or Multiple